Simplifying the Jargon in Plain English - Economic, Political & Astrological perspectives at : Rahul's Café Canadian

Hello Friends,

Repeating the previous concerns.

Physical Gold & Silver hold more value than paper & there is evidence of the shortages of actual physical delivery in Precious metals and we must not ignore the ground realities.

There is a huge disconnect between the Paper Markets (Satta / speculators ) & the Ground realities with physical demand from India & China creating a supply shortage in Bullion.

Some recent events happened last week - which are hard to ignore & very amusing :

"...early in the week, a sell order for 600,000 oz. gold crushed bullion prices and before trading Friday Oct/11, a 5000 unit sell of futures on COMEX briefly stopped trading and knocked gold down from $1305 to $1267 / oz....."

Precious Metals Paradox: Good Fundamentals Help And Hurt - Seeking Alphahttp://seekingalpha.com/article/1742782-precious-metals-paradox-good-fundamentals-help-and-hurt?source=google_news

This 600k oz sell order is equivalent to over 19 Metric Tons of Gold. Does anyone even have those surplus quantities available or is it just Paper flying around.

Firstly we need to know who has such surplus quantities of Gold to sell & if at all you have those quantities available, then why would they want to offload all that quantity in one day on an already depressed market = does'nt make any sense.

We all know its the speculators & market manipulators & those with vested interests who do not wish to see the Bullion prices rise.

However the time is coming - when people will loose faith in the paper markets. As we all know they are being manipulated.

Take a look on the other side of the Ocean & have a look at the actual physical demand vs shortage in physical supply of Bullion.

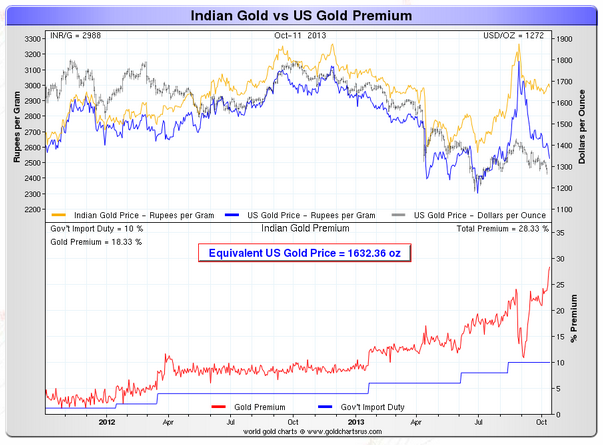

Take a look at the above chart & understand for yourself the ground realities as they exist.

COMEX New York Spot Price of Gold = $1272

Indian Gold Bullion prices physical delivery = + 10% Gov't Import duty + 18.33% Premium for physical delivery (above the spot price) = $1632.36 per oz (equivalent to approx Rs 32,400 per 10 grams)

Yet people are lining up to buy physical Gold that they can hold in their hands, as they expect future supply shortage.

Traders & speculators may continue to sell truck loads of paper gold in the market to depress the prices. However the disconnect between the physical Bullion & paper markets will continue to widen, until there is no more physical bullion left to be sold at these low prices.

Wake up & smell the coffee.

Hold onto your physical metal & wait till the prices spike before you decide to sell any.

Indian Gold Premiums Surge To All-Time Highs As Gold Seems To Be In Short Supply In The World's Largest Market - Seeking Alpha

http://seekingalpha.com/article/1745092-indian-gold-premiums-surge-to-all-time-highs-as-gold-seems-to-be-in-short-supply-in-the-worlds-largest-market?source=email_macro_view&ifp=0

Indian Premiums Surge $30 To Record On Physical Demand, Supply Crunch - 24h Gold

http://www.24hgold.com/english/news-gold-silver-indian-premiums-surge-30-to-record-on-physical-demand-supply-crunch.aspx?article=4570394038G10020&redirect=false&contributor=Mark+O%27Byrne

Indian Gold Premiums Surge $30 To Record On Physical Demand, Supply Crunch

http://www.commoditytrademantra.com/gold-trading-news/indian-gold-premiums-surge-30-record-physical-demand-supply-crunch/?utm_source=twitterfeed&utm_medium=linkedin#!

Best Regards,

Hello Friends,

Repeating the previous concerns.

Physical Gold & Silver hold more value than paper & there is evidence of the shortages of actual physical delivery in Precious metals and we must not ignore the ground realities.

There is a huge disconnect between the Paper Markets (Satta / speculators ) & the Ground realities with physical demand from India & China creating a supply shortage in Bullion.

Some recent events happened last week - which are hard to ignore & very amusing :

"...early in the week, a sell order for 600,000 oz. gold crushed bullion prices and before trading Friday Oct/11, a 5000 unit sell of futures on COMEX briefly stopped trading and knocked gold down from $1305 to $1267 / oz....."

Precious Metals Paradox: Good Fundamentals Help And Hurt - Seeking Alphahttp://seekingalpha.com/article/1742782-precious-metals-paradox-good-fundamentals-help-and-hurt?source=google_news

This 600k oz sell order is equivalent to over 19 Metric Tons of Gold. Does anyone even have those surplus quantities available or is it just Paper flying around.

Firstly we need to know who has such surplus quantities of Gold to sell & if at all you have those quantities available, then why would they want to offload all that quantity in one day on an already depressed market = does'nt make any sense.

We all know its the speculators & market manipulators & those with vested interests who do not wish to see the Bullion prices rise.

However the time is coming - when people will loose faith in the paper markets. As we all know they are being manipulated.

Take a look on the other side of the Ocean & have a look at the actual physical demand vs shortage in physical supply of Bullion.

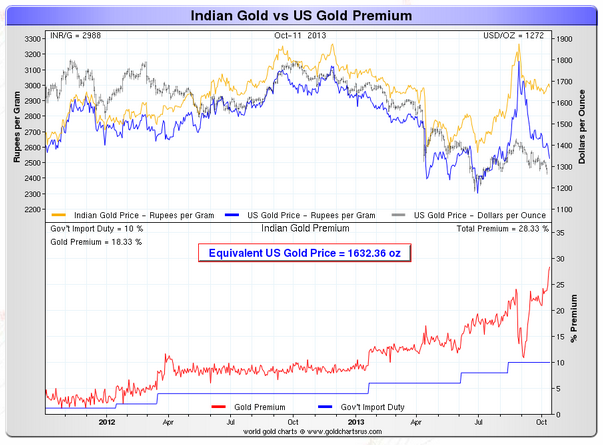

Take a look at the above chart & understand for yourself the ground realities as they exist.

COMEX New York Spot Price of Gold = $1272

Indian Gold Bullion prices physical delivery = + 10% Gov't Import duty + 18.33% Premium for physical delivery (above the spot price) = $1632.36 per oz (equivalent to approx Rs 32,400 per 10 grams)

Yet people are lining up to buy physical Gold that they can hold in their hands, as they expect future supply shortage.

Traders & speculators may continue to sell truck loads of paper gold in the market to depress the prices. However the disconnect between the physical Bullion & paper markets will continue to widen, until there is no more physical bullion left to be sold at these low prices.

Wake up & smell the coffee.

Hold onto your physical metal & wait till the prices spike before you decide to sell any.

Indian Gold Premiums Surge To All-Time Highs As Gold Seems To Be In Short Supply In The World's Largest Market - Seeking Alpha

http://seekingalpha.com/article/1745092-indian-gold-premiums-surge-to-all-time-highs-as-gold-seems-to-be-in-short-supply-in-the-worlds-largest-market?source=email_macro_view&ifp=0

Indian Premiums Surge $30 To Record On Physical Demand, Supply Crunch - 24h Gold

http://www.24hgold.com/english/news-gold-silver-indian-premiums-surge-30-to-record-on-physical-demand-supply-crunch.aspx?article=4570394038G10020&redirect=false&contributor=Mark+O%27Byrne

Indian Gold Premiums Surge $30 To Record On Physical Demand, Supply Crunch

http://www.commoditytrademantra.com/gold-trading-news/indian-gold-premiums-surge-30-record-physical-demand-supply-crunch/?utm_source=twitterfeed&utm_medium=linkedin#!

Best Regards,

--

Rahul Vashisht

Quote : Turn your face towards the sun and the shadows fall behind you.

Quote : Turn your face towards the sun and the shadows fall behind you.

No comments:

Post a Comment